Never Retire: The Structure That Let Me Slow Down Without Falling Behind

Spain didn’t save my budget—this work-meets-money philosophy did

The notion of Never Retire doesn’t start with geography. It begins with how you tie income to expenses and keep both lean, meaningful, and flexible.

Moving to Spain not only lowered my cost of living but validated a structure I’d already built—a structure that allowed me to slow down without falling behind.

In concrete terms—

Today, Orange—our mobile carrier and internet service provider—debited my bank account 60.95€ for two unlimited mobile lines and home fiber internet. In the United States, we paid $150 a month through two different providers.

This morning, my wife and I split a bocadillo (sandwich) with jamón, cheese, and olive oil and had two cafe con leches for 8.40€. The US equivalent would have cost a minimum of $20.

I have more than sufficiently documented the market cost savings—super and otherwise.

Here in Spain, we don’t have a car. We rarely step foot in one (I think we have three times in six months). And we have used public transportation to the tune of—averaging it out—maybe a few euros a month. In the US, we were dropping $500-$600 a month—easily—on transportation when I had a car payment, and around $200-$300 without one.

Even with higher housing costs (for us) in Valencia—

At 1,500€, our rent here is higher in USD than in LA, where we had rent control.

It costs about 120€ a month for electricity and water in Spain compared to NO utility expenses in LA.

—our fixed cost of living here is easily 30%-40% lower than in LA.

Plus, we have way more flexibility with our discretionary spending, tax management, and future plans.

Long before we left the US, I had already started disconnecting from the kind of lifestyle that forces you to keep earning more to cover fixed costs.

I stopped trying to “live like a successful adult” and started building around needs and wants that actually made my life better.

That’s the part most people miss. Spain didn’t save my budget—I just stopped budgeting around bullshit. I started connecting specific income streams to specific expenses. And I started saving in ways that felt effortless because they were directly tied to my strategic choices and spending patterns.

Here’s a sketch of how I did/do it—

Track what you actually spend on housing, food, health, and going out. Tie these expenses to what matters emotionally—not just what looks smart in a spreadsheet.

Set a flexible income floor—not a stretch goal. Then, build the least demanding work life that meets it.

Use automatic savings rules tied to real spending. Like:

Every time you spend, save a little. In Spain, Santander Bank rounds every debit card purchase I make dos unidades superior (two upper units). So, if I spend 8.40€, the bank automatically sends 1.60€ to savings.

Each time you receive income, set aside a percentage to save and another to invest when you forecast a monthly surplus and can remain comfortable and cushioned even with saving and/or investing.

Don’t spend money on an identity you don’t want to maintain. Skip the car lease if you want to walk. Cut the subscriptions that belong to your old life. Let your lifestyle shrink, then rebuild it around what you actually want to keep. It’s all about the choices we make and letting go of (American and type A) societal norms and expectations around how much money we need to make and how and why we should spend it.

You don’t need to save your way to some theoretical retirement. You need to spend intentionally now to work less later without catching up.

Working less now = being able to work less longer. That’s the idea.

Creating a life (and a budget) where your fixed expenses are low enough to leave room for choices. That’s the goal.

Of course, place matters. But it’s all about what you need, want, and value.

To be a happy human living life to its fullest expression, I need and want—

To not have a car

To live in an urban environment where car ownership is actually a pain in the ass

To be able to live life outside regularly and freely doing the things I love to do—ride my bike, go to the beach, swim in the sea, walk aimlessly, feel life in my neighborhood, and have ample green spaces, public places, and bars, restaurants, and cafes where I can experience and be part of a unique vibe that’s logistically and financially impossible to attain in the United States due to horrible urban planning and a corrosive economic and political landscape.

All of this—lower fixed costs, more flexibility, work-life alignment—has allowed me to slow down without giving anything up.

I still work. Obviously, I have to.

But Never Retire isn’t about quitting work—it’s about changing your relationship with it.

Like most people, I didn’t come to Never Retire as a bold choice—I arrived there because I had to.

At first, it felt like a failure. Like I hadn’t made it.

But once I started stripping away what didn’t serve me—financially and otherwise—I realized this wasn’t settling. It was the smarter, saner way forward.

Never Retire starts as a fallback. Then it becomes freedom.

So—as much as is reasonably possible—I work on my terms. I protect my time, my energy, and my priorities—professionally and personally.

I know what’s worth doing, what’s worth dropping, and what enough looks like—right now and down the road.

That’s what I’ll explore in the next issue:

Why I work the way I do—and what I quit for good.

It’s not about escaping work altogether. It’s about reshaping it to support the life I’ve already built—not the one we’re told to chase.

🇪🇸 Language Corner

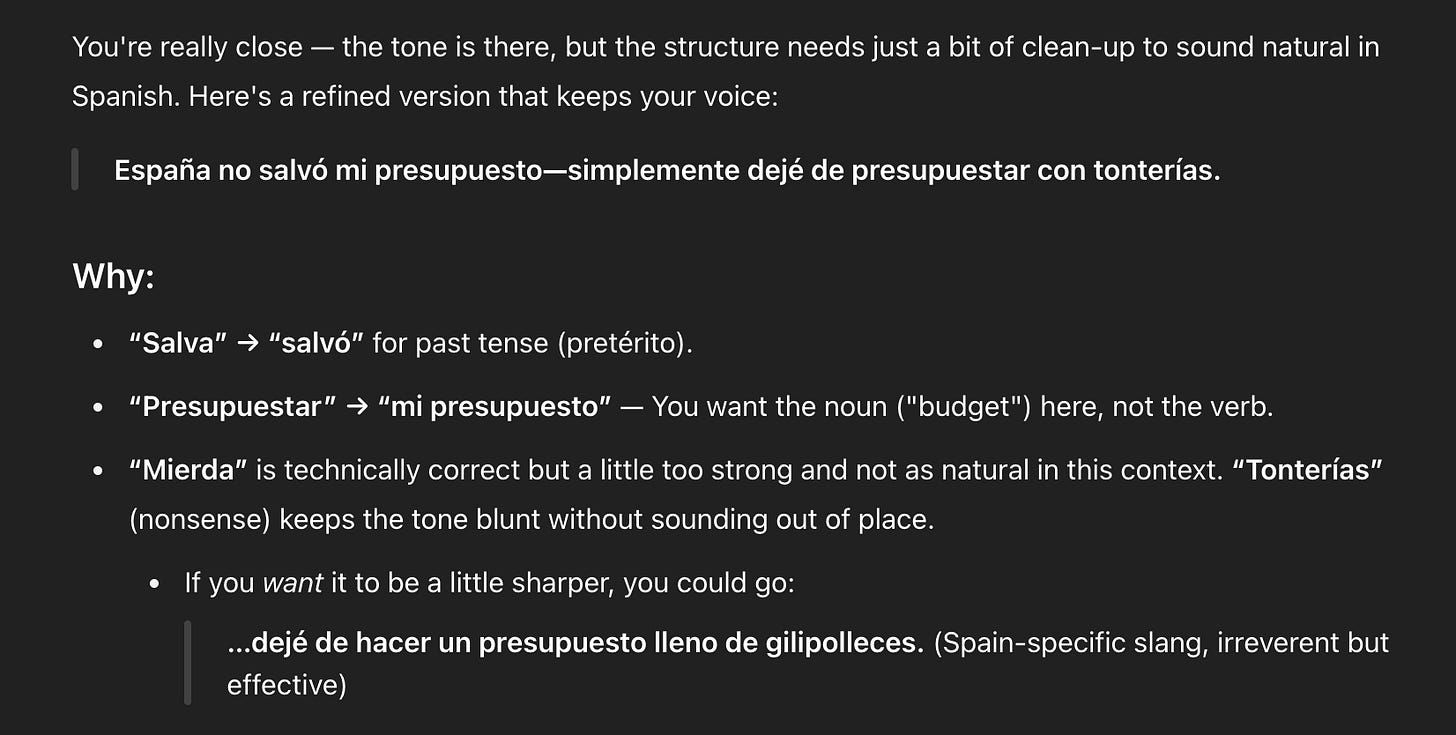

Spain didn’t save my budget—I just stopped budgeting around bullshit.

España no salva mi presupuestar—solo dejar de presupuestar sobre mierda.

You don’t need to save your way to some theoretical retirement. You need to spend intentionally now to work less later without catching up.

No necesitas salvar tu manera a algo jubiles theoretical. Necesitas gastar con intention ahora para trabajar menos tarde sin alcanzar.

I still work. Obviously, I have to.

But Never Retire isn’t about quitting work—it’s about changing your relationship with it.

Todavía trabajo. Obviamente, tengo que trabajar.

Pero Nunca te jubiles no es quitar trabajar—es sobre cambiando tu relación con trabajar.

"Creating a life (and a budget) where your fixed expenses are low enough to leave room for choices. That’s the goal." I love how you encapsulated a seemingly simple yet profound idea.

Having choices is key - even if sometimes they might not be great - having them matters. I came to this realization many years ago and made sure I taught my kids what you described.

What is that translation service you use?