Never Retire - Who's To Blame For Pathetic Retirement Savings: The Retirement Industry Or Us?

That’s the latest data illustrating meager retirement savings among Americans.

It comes via a CNBC article summarizing a super long report from Vanguard on the savings habits of Americans. Given how huge Vanguard is—the company has tens of millions of customers—I trust the data.

The side-by-side of median versus average savings underscores the problem. Even the averages—obviously buoyed by outliers on the high end—flat out suck.

Across age groups, the median account balance of Vanguard participants was $35,345 in 2021. The average was $141,542. If not for a strong stock market last year these numbers would be considerably lower.

It’s no wonder so many people will Never Retire.

Of course, we’ve built this newsletter around the idea that Never Retiring isn’t a bad thing. In fact, if you embrace it wholeheartedly and make the necessary lifestyle and financial adjustments—tailored to your unique situation—it could very well beat the hell out of traditional retirement.

However, most of the nation, led by the retirement industry and financial media, hasn’t caught on. They’re still chasing the runaway American dream.

Case in point—the conversation around working longer/working in retirement.

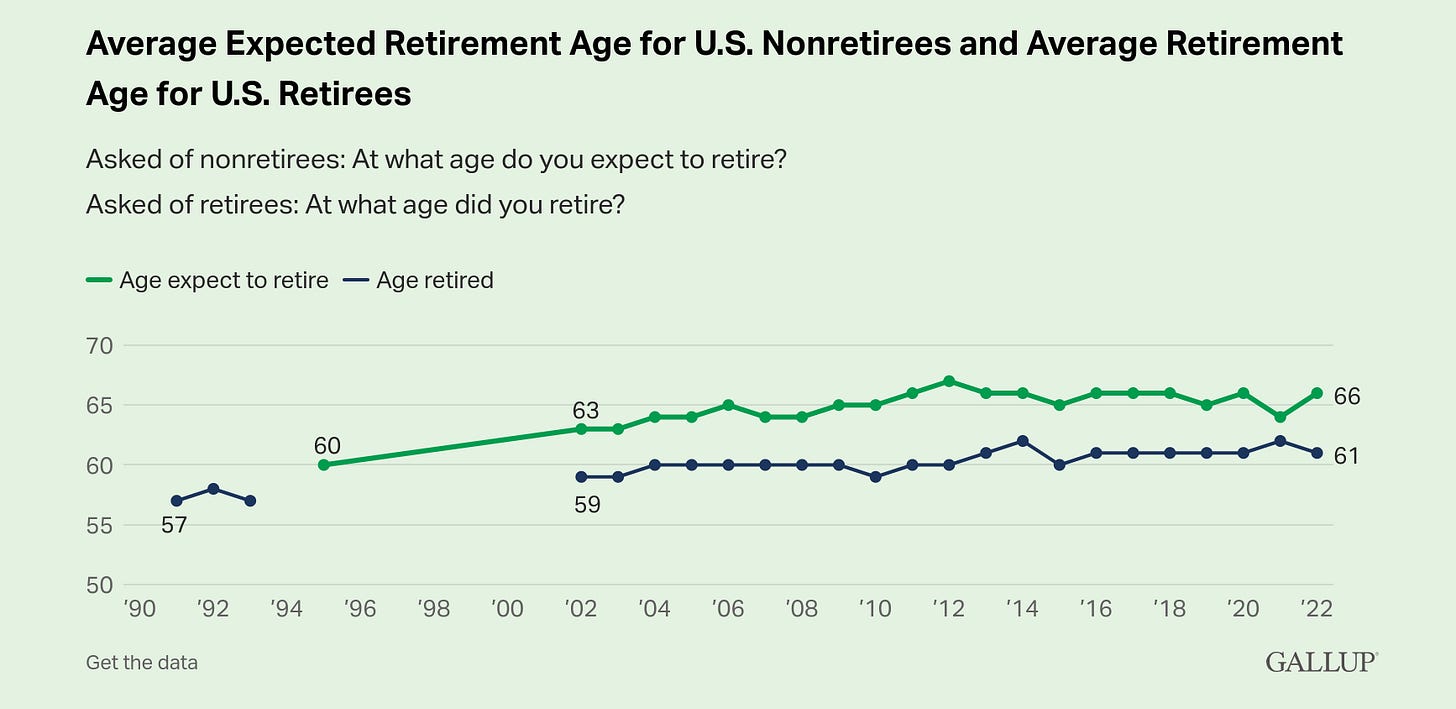

According to Gallup poll, non-retirees expect to retire at age 66. In 1995, that number was 60 years old.

The image Gallup used to accompany its story tells you all you need to know.

If you’re forced to work in retirement, you’re destined to stock shelves in a grocery store.

Not that there’s anything wrong with stocking shelves in a grocery store. But it just comes down to having choice in the matter.

You have a better shot at having choice in the matter, the sooner you acknowledge and embrace the reality that you’ll Never Retire and, subsequently, start planning for it.

However, the retirement establishment offers scant helpful advice—let alone realistic, concrete solutions—to deal with the issue.

The government routinely changes rules around tax-deferred retirement accounts.

Not helpful for large swaths of people who haven’t saved enough.

The financial media and retirement planners default to save more.

Not helpful for people with income, cost of living, and other objective or self-inflicted constraints.

Instead, all of the above look at the person with $100,00, $200,000, $300,000 or much less saved—nowhere near that traditional retirement magic number of $1 million—and imply, if not infer that the individual did something wrong.

You’re to blame. You’re deficient. You’re less than. You made a mistake.

Blows my mind how our society tends to take clearly collective problems—not just around retirement and saving money—and frame them as individual failures.

What we try to do here is offer a wide array of solutions you can consider in association with your particular circumstances.

You have what you have saved. You’re probably not going to get to a million or whatever you’d require to quit work—or to stop generating some form of cash flow—altogether. So accept it and start planning—like right now—accordingly.

This might mean:

Taking what you managed to save and using it to drastically reduce or eliminate your housing payment.

Buy income property to fund relative old age as a landlord.

Find a way to invest your money to fund, all or in part, your present and/or future.

And so on.

Anyhow, in the coming weeks, we’ll continue to evolve our Never Retire strategies, with a focus on general personal financial plans, housing, travel, and investing your money, particularly in dividend-paying stocks and ETFs.