A Potentially Exciting Semi-Retirement Approach And Definitely Exciting Plans For This Newsletter

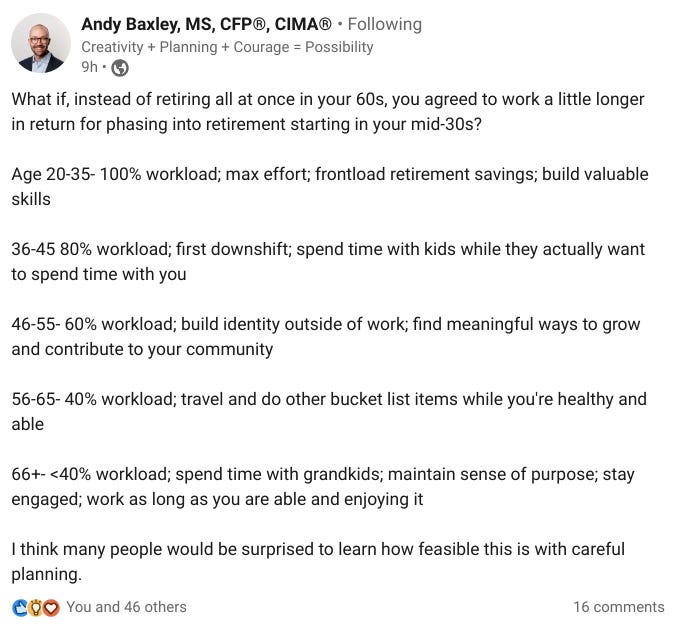

Coincidentally, a newsletter subscriber, who also happens to be a financial planner, sent me the following LinkedIn post after I wrote the last installment on how I view my work unfolding over the next few years.

Semi-retirement is catching on. Even among financial advisors. So, let’s talk about that.

But first—

The other day I mentioned plans for newsletter content during our February 2024 trip to Spain and France. It’s less than four months away! See that post for a glimpse into what we did last year.

Today, more specifics—

In February, expect 17 posts—

7 posts from each of the seven cities we’re visiting (Barcelona, Girona, Montpelier, Lyon, Paris, Bordeaux and Toulouse) with urban and food photography, cost of living comparisons and general observations as they relate to Living The Semi-Retired Life.

10 posts that take a traditional personal finance or investing topic (think 401(k)s, financial planners, money market funds or accounts) and relate them to the non-traditional path you might be following or want to follow.

Because you can use traditional methods and strategies to reach alternative goals and outcomes. I write a lot about traditional money approaches. And I think this newsletter will benefit from having more of that insight applied to our core themes.

What we did last February, what we will do this February and how we include elements from those months throughout the year highlight the reasons why you should become a paid subscriber.

Once we move to Spain, the focus shifts to how our semi-retired life will undoubtedly change in a new country alongside a look at the frequent travel my partner and I plan to do around Europe for many years to come. We won’t quite be digital nomads, but we’ll be close.

I’m in this for the long haul.